A newsletter on upcoming food and beverage trends that offers a curation of brands and aesthetics written by Andrea Hernández.

Snaxshot is ad-free as we are community funded, if you enjoy our content, contribute here. 🤗

🔮 Peek into the future:

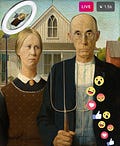

scrolling is the new strolling

PDD & live streaming produce

Facily & group discount grocer

enter the GrocerGram

Delli & one stop F&B drops

meet the pantry "Kiths”

latest stop, cop and drop

spoonful of news

Come on in, the water’s warm, you know you want to!

Aisles, They-Are-A-Changing

If you’ve been here long enough you know we’ve been preaching about the changes happening in grocers for a while now, recall our CaaS (curation as a service) issue from back in March in which we detailed the rise of the curated grocer and niche marketplace as a global phenomenon. The aisles, they are a changing, and no we aren’t really going to be discussing 10-minute grocery deliveries because in our humble opinions, nothing really merits that much immediacy, unless…

Keep reading with a 7-day free trial

Subscribe to Snaxshot to keep reading this post and get 7 days of free access to the full post archives.