A newsletter on upcoming food and beverage trends that offers a curation of brands and aesthetics written by Andrea Hernández.

You can support Snaxshot monthly now!

🔮 Peek into the future:

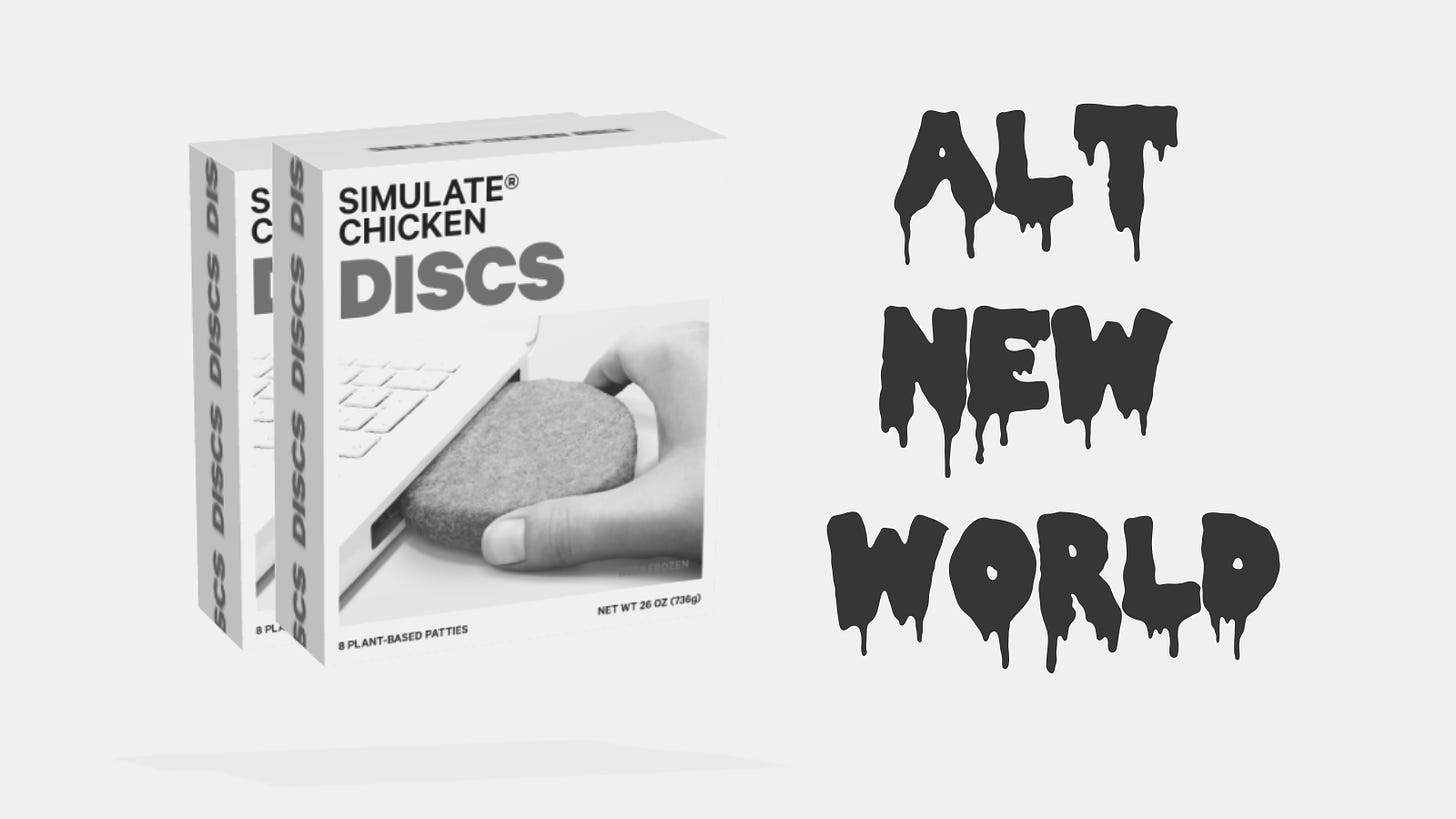

Enter a brave new alt-world.

Snaxshot of market + who’s making moves.

Favorite brands in the space.

Market challenges + opportunities.

Don’t be shy, the water’s warm, don’t forget to hit the subscribe button below.

“I ate civilization. It poisoned me.”

—ALDOUS HUXLEY, Brave New World

Dispatch from a place of nutritional fulfillment, it’s your favorite host with high hopes that you read this title to the tune of Gary Jule’s “Mad World” for added effect. A world gone mad with overconsumption, which has sparked a debate on whether or not our food supply as we know it can sustain it. Hence the rise of the Alts that are here to cater to “flexitarians” and vegans alike while providing more sustainable solutions to a growing world population.

If 2019 proved to be a prosperous year for alt-foods, think Beyond’s IPO and BigFood™ debuting their own alt-lines, the pandemic of 2020 only served to solidify the foundations of our BRAVE NEW ALT-WORLD.

In The Beginning There Was Demand 🌅

—In 2018, global plant-based milk sales reached an estimated $16 billion and projected to reach $38 billion by 2024.

—Global plant-based meat sales hit an estimated $4.6 billion in 2018.

—In the US alone, retail sales of plant-based meat is estimated $1 billion in 2020.

—The seven countries that are leading in plant-based food innovation: the United States, United Kingdom, Canada, Germany, Netherlands, Brazil, and Israel.

—Between 2017 and 2019, retail sales of plant-based meat grew 31%, while total U.S. retail meat sales grew just 5%.

—As of 2018, 6% of Americans say they followed a strictly vegetarian lifestyle, while 3% followed a strictly vegan lifestyle according to Nielsen.

—Alt-dairy market grew by 60% in five years and as of 2019 held a 12.6% market share from dairy products.

—According to Nielsen, plant-based food has posted double digit growth since 2018. During the early days of the pandemic, sales of plant-based meat surged 264%.

—2020 has seen $1.5 billion invested in alt-food, $435 gone towards microbial fermentation as it seeks to become third pillar of alt-protein industry.

—Impossible CEO forecasts by 2035, tech will replace the use of animals in food industry.

—PepsiCo launched its GreenHouse Accelerator program partnering with upcoming plant-based players.

—Unilever set sales target from plant-based meat and dairy alternatives at $1.2 billion in next 5-7 years.

—JBS, the world’s largest meat company, launched their plant-based burger earlier this year, OZO.

—Chobani released an oat-based lineup of yogurts, creamers, and milks that hit shelves during 2020.

God’s Favorite Alt-Food 😇

Beyond Meat: IPO’d bringing in over $760 million for the company and investors back in 2019. In 2020, Beyond Meat continues to thrive as pandemic shocked meat supply, saw growing demand from retailers.

Here’s a few more updates from them:

—Launched DTC site.

—Beyond Meatballs now available at Costco.

—Launched their alt-patties products in Brazil.

—Collaboration with Pizza Hut, McDonald’s and announced more “fast-food” collaborations in 2021.

Keep reading with a 7-day free trial

Subscribe to Snaxshot to keep reading this post and get 7 days of free access to the full post archives.